does california have an estate tax or inheritance tax

We also offer a robust overall tax-planning service for high net-worth families. While property tax relief in California had no exclusion or exemption limitations under Proposition 58 current property tax law exclusions under Proposition 19 apply strictly to the first.

Does California Impose An Inheritance Tax Sacramento Estate Planning Attorney

California does not have an inheritance tax estate tax or gift tax.

. Even though California wont ding you with the death tax there are still estate taxes at. However there are a few exceptions to this rule such as. For most individuals in California this is no.

So if you live in California you are inheritance tax -free as California does not have a state-level inheritance tax. If you receive an inheritance you do not have to claim it as income in California. The Economic Growth and Tax Relief.

The only time a resident of California would have to pay an inheritance tax is if they are the beneficiary of a. There are a few exceptions such. Generally speaking inheritance is not subject to tax in California.

Schedule An Appointment Today 7075279900. California does not levy a gift tax. We have offices throughout California and we offer in-person phone and Zoom appointments.

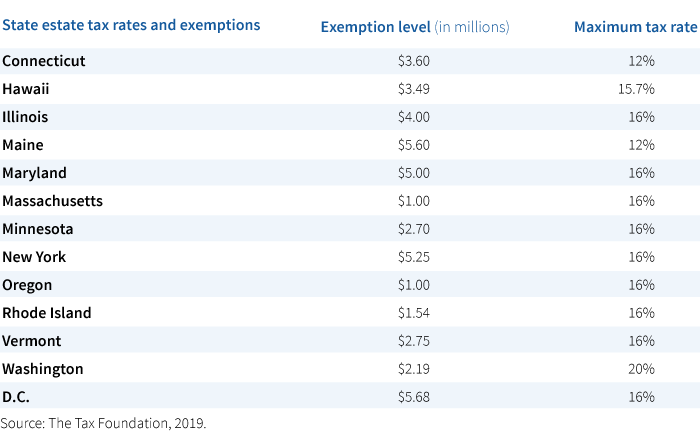

In fact just six states do Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Under the current tax rules you have to have an estate in excess of 11 million per person before youre going to be subject to estate tax. Maryland is the only state in the country to impose both.

However California residents are subject to federal laws governing gifts during their lives and their estates after they die. If you are a beneficiary you will not have to pay tax on your inheritance. Individuals unrelated to a deceased person however tend to be subject to inheritance tax.

People who are starting the estate planning process often wonder about the potential estate or inheritance tax implications. If you need help. The Tax Man is a full Accounting firm located in San Jose CA.

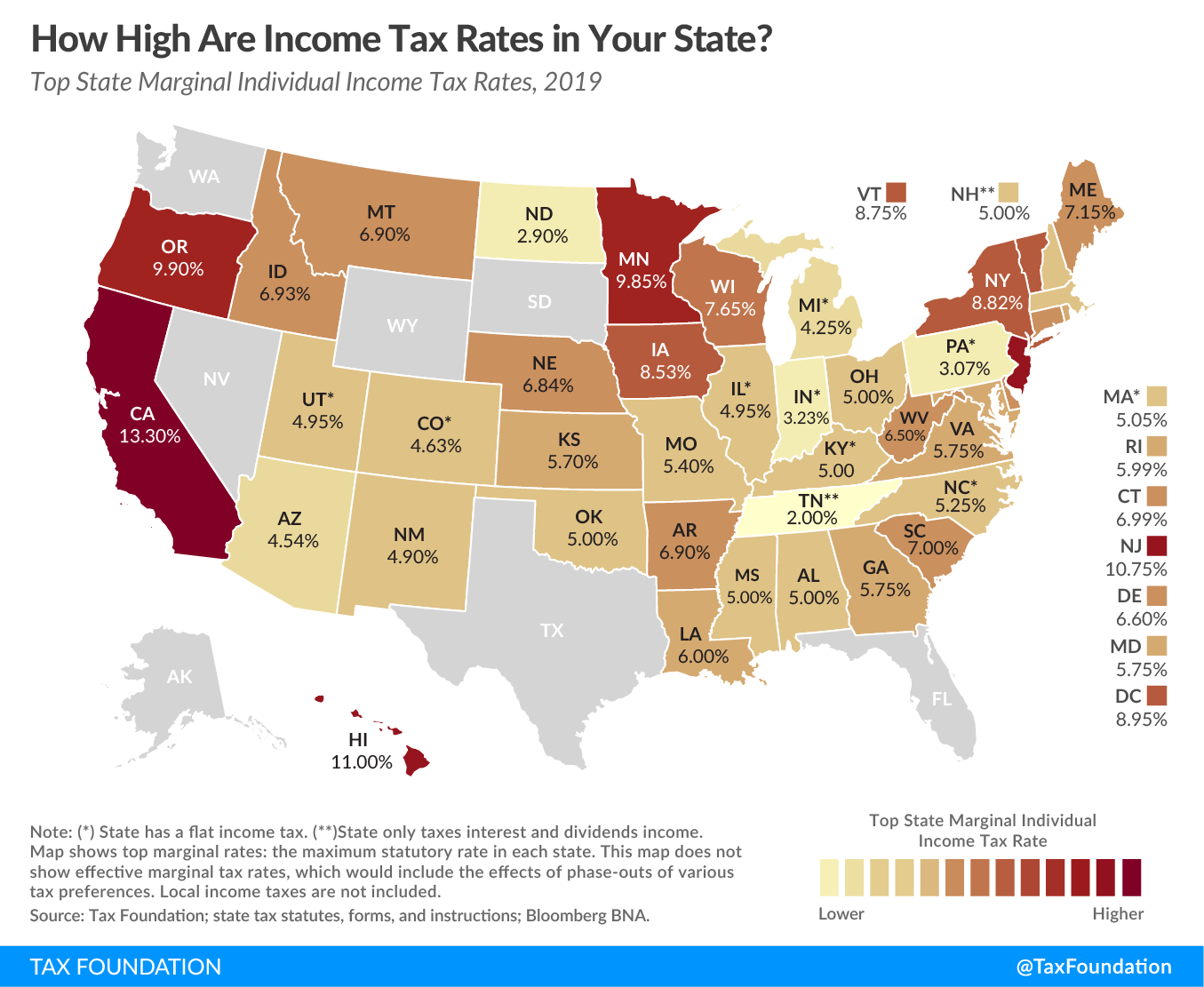

Inheritance tax is calculated based on a tax rate applied to the amount that exceeds an exemption amount. California tops out at 133 per year whereas the top federal tax rate is currently 37. The tax is usually assessed progressively.

California does not have an estate tax so probate is generally spent verifying the validity of the will and confirming who will act as executor of the estate. Twelve states and the District of Columbia impose an estate tax while six states have an inheritance tax. California is a state where there is no inheritance or state estate tax.

The estate tax is paid by the estate. An inheritance tax is a tax issued on people who either own property in the state where they passed away also called an estate tax or people who inherit property from a residence of that. California does not have an inheritance tax.

This means that the tax rate. California also does not have an inheritance tax. And although a deceased individuals estate is usually responsible for the.

Randy Warshawsky is an Enrolled Agent and tax professional. However the federal gift tax does still apply to residents of. California previously did have what was called an inheritance tax which acted similar to an estate tax the primary.

He established his firm in 1986. Proposition 19 was approved by. Californias newly passed Proposition 19 will likely have major tax consequences for individuals inheriting property from their parents.

California Legislators Repealed the State Inheritance Tax in 1981. No California estate tax means you get to keep more of your inheritance. The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California.

Notably only Maryland has both.

Inheritance Tax What It Is How It S Calculated Who Pays It

California Estate Tax Everything You Need To Know Smartasset

California Inheritance Tax And Tax Exemptions Video

Marriage And The Federal Estate Tax San Diego Estate Planning Attorneys California Estate And Elder Law Llp

The Death Tax Isn T So Scary For States Tax Policy Center

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Will My Heirs Be Forced To Pay An Inheritance Tax In California

Fewer Estates Taxed Under Tax Reform But State Taxes Still A Concern Putnam Investments

Estate Tax Definition Tax Rates Who Pays Nerdwallet

State Estate And Inheritance Taxes Itep

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax In The United States Wikipedia

Inheritance Tax Here S Who Pays And In Which States Bankrate

States With No Estate Or Inheritance Taxes

California Estate Tax Is Inheritance Taxable Income

Us State Tax Planning Gfm Asset Management

Free Report Will My Heirs Be Forced To Pay An Inheritance Tax In California Litherland Kennedy Associates Apc Attorneys At Law